Legacy Certificate: A Gift That Keeps Giving

Open a Legacy Certificate for the young person you care about. Whether it’s a gift for a special occasion or part of your estate plan, a Legacy Certificate can help them with future expenses like:

- Education/Tuition

- Once-In-A-Lifetime Trip

- First Car or Truck

The Legacy Certificate is a minor account with an 18-month term opened in the young person’s name (age 17 or younger). As a member, you create the account and schedule regular deposit transfers from your account to keep the balance growing.

When the certificate matures, the young person can use the funds to pursue their education, take a trip, or handle expenses. More good news: Cinfed will help get you started by matching your first $50.*

Give the gift that keeps on giving — and sets them up for future success! Click below to get started.

Financial Growth As They Grow

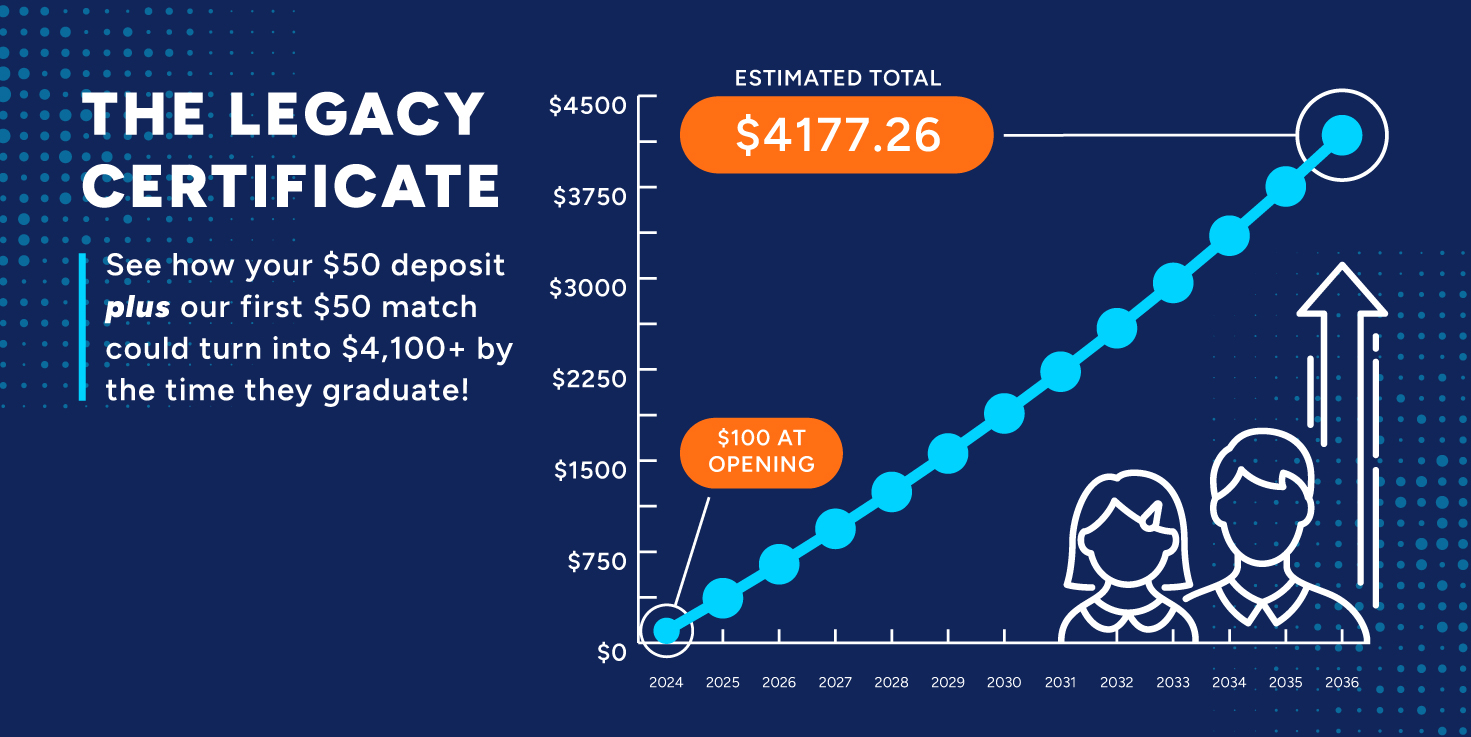

Saving now can pay off over the long term. Imagine presenting a big check at graduation to your child or grandchild that allows them to pursue their dreams. Your initial $50 deposit plus $5 deposits per week over time could grow into more than $4,000 over 12 years! Start the savings journey now so they can reach their goals in the future.

For illustrative purposes only; based on current rates; actual rates may vary.

*Minimum required to open account: $50; Cinfed will make a one-time deposit of $50 at account opening with required minimum opening balance and recurring transfer deposits. Automatic monthly transfers from another Cinfed account or an outside institution should be maintained until the maturity date. Additional deposits can be made to the account until the maturity date stated on the account. The term for this account is 18 months with automatic renewal to an 18 month certificate. One account per minor child permitted. Only available on General Membership, Custodian, and UGMA/UTMA accounts. All other terms identical to a standard certificates.